PhD-2-CEO: the Three-Letter Shift of the Researcher Entrepreneur

Following up on last week's post on the current compute crunch and its impact on researcher career paths, we're digging today into a few of the common traits or similar experiences I've witnessed when chatting with soon-to-be researcher entrepreneurs.

"It depends" is my answer.

- Yes, we’re certainly seeing more researchers, with venture-type ambitions, looking to build large inherently research-heavy businesses.

- No, I’m not sure this will be a sustained trend, or at least not to the extent it is currently being framed.

I don't think anyone wakes up in the morning telling themselves "I AM AN ENTREPRENOOOR". It shouldn't take too much introspection to get a feel for your ability to gather folks around a common goal, have people buy-into your ideas or your personal impatience towards hierarchy or processes. These traits could all be soft signals of wanting to spin-off and chart your own path.

Is the current influx of researchers the result of an intrinsic entrepreneurial drive or rather an opportunistic impulse?

Who knows, all I can say is that many researchers I meet currently tick 2 to 3 of the points below:

- Seeing peers raise what seem to be large venture rounds

- Constrained resources at their current organisations

- Impatience or frustration within their organisations

Seeing peers raise what seem to be large venture rounds:

Similarly to what I've witnessed in 2021 with C-levels/VPs at Series D-E-F, there seems to be some misguided expectations when it comes to entrepreneurship. Some smart operators (here researchers) are seeing their not-necessarily-more-accomplished former colleagues raise significant capital to build out their vision. It seems that some researchers come to the venture market with ill-informed perspectives akin to "If this person has raised $X million, then I should easily be able to raise $X+Y million".

Constrained resources within their existing organisations:

Some researchers realise that the resources needed to take their research to the next level isn't available within their current setup (public labs). Others are feeling constrained by the availability of those resources (strategic direction of private labs shifting to follow business priorities). Some researchers have the feeling that the grass is greener in startup-land where you can seemingly raise easy capital with a good CV and a smart-sounding idea. This may well be true for this crazy period we're going through but the question is how long will this hold for?

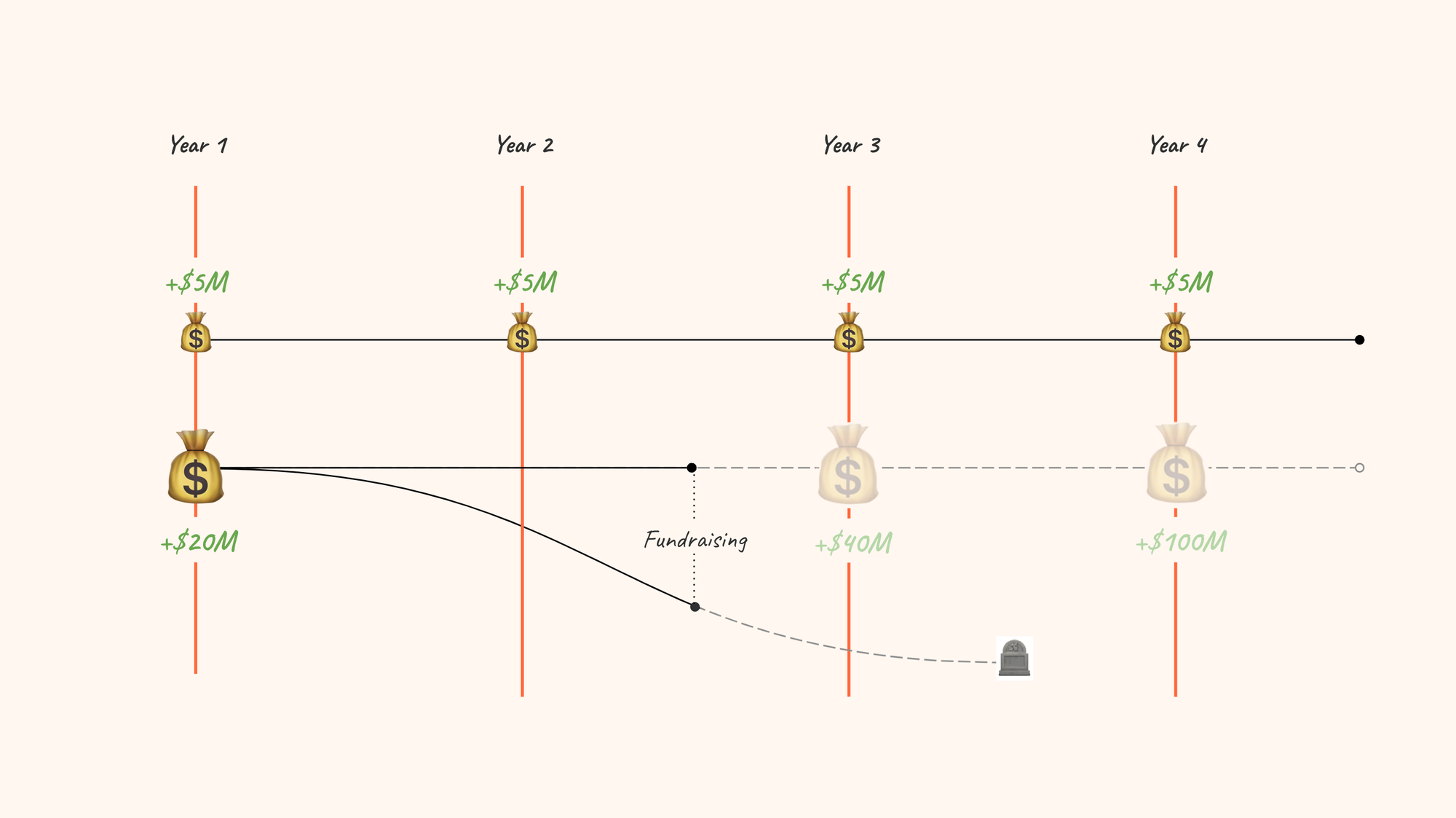

Let's run the numbers: If you currently have a $5m annual budget for your team and compute, a $20m funding round may sound appealing as you'd be able to move faster right? Well not necessarily.

This $20m funding will be put to work towards delivering on a commercial proposition leveraging your research. In order to hit those milestones, you may end up spending $10m a year and have to go out to raise a new round of funding in 18 months. That's certainly more than your 5m but how comfortable are you that your research will be packaged in a way that finds product-market-fit or hints at it? Have you considered all the peripheral expenses to which you aren't exposed to today? What would happen to your startup in 18 months if you fail to raise? The $5m a year within the safety of a lab may all of a sudden regain appeal.

Impatience or frustration within their organisations:

The Deepmind and Google Brain merger seems to have scarred a few researchers. Politics has been introduced into the world of research and some don't have the patience to deal with it anymore. This isn't just a Deepmind problem though. In academia, the role of a researcher has become more bureaucratic and tied to KPIs which feel distant from the research that is being conducted (reporting on metrics such as the size of ones team, the funding won, or the citations which could be fueling the arxiv boom).

A former professor framed it this way:

As research has become increasingly private, those who understand that their value on the job market rests on publishing research and gaining peer recognition are growing frustrated. Joining or starting an open-source startup can feel like the best of both worlds.

The general fundraising blur

I've had conversations with researchers who came to the market asking for a certain amount to get going and spin-out their work from private labs into an autonomous entity. When breaking down that amount, the maths didn't really add up. But then again the valuations in this space don't really add up either so who is to blame? For researchers who aren't necessarily well versed into venture-capital dynamics, raising $15-30-50-heck-100m as an inaugural round may seem perfectly justified.

Are VCs now financing research?

- This LLM wave is an innovation that has fundamentally collapsed the time between "research" and "in-production delivering tangible results". Open-source developments have fast-tracked this acceleration. While HuggingFace may not have brought the latest LLM breakthroughs, they may have had some breakthroughs on the chemical front. I have no other rational explanation to explain how their engineers are able to replicate research and push them to the Hub at this pace. 🏃

- In this sense, venture capital firms have been far more excited about the prospect of funding such research bets because the commercial timeline is "now", not "tomorrow" and even less so "someday maybe". With this in mind, you could argue that the bets on Anthropic, Cohere or Mistral rest on their ability to contribute to state of the art research but also, perhaps more importantly for VCs, aggressively commercialize their models to capture the latent demand for LLM/GenAI technology.

- While risk appetites are evolving, most traditional venture firms aren't queuing to invest in quantum businesses, mainly because the time horizon towards economic value is still uncertain and in the "someday maybe" category. The J-curve of venture isn't particularly well suited to unproven R&D bets. It doesn't mean they don't exist! Some funds will allocate a smaller % of their fund to those bets, some funds will find Limited Partners willing to fund a thesis which involves long hold periods and increased uncertainty.

If you're a researcher thinking about going down the entrepreneurial path, feel free to drop me a message — no need to have all the answers, I'll do my best to help. Here's something my shift from data to venture hammered home: admitting 'I don't know' commands respect, perhaps even more so in a venture world that values vocal certainties. As a scientist, curiosity is your compass, 'I don't know' simply means... 'let's find out.' 🙂